401k calculator with catch up contributions

The plan treats 6000 of Marys deferrals as catch-up contributions. Tom is a participant in a 401 k plan.

401k Catch Up Contributions Retirement Catch Up Limits

000 50000 100000 150000 200000 250000 300000.

. First all contributions and earnings to your 401 k are tax deferred. What are the 401k contribution limits in 2022. 2022 There is an alternative limit for governmental 457b participants who are in one of.

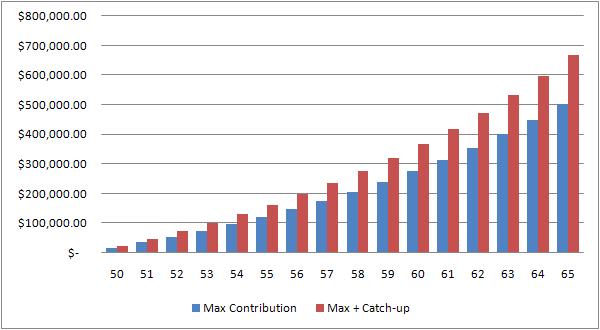

Account values for the next 20 years. However if the total catch-up contribution is made it will increase to 27820. This 401k contribution calculator helps streamline the process of figuring out how much you should contribute toward your 401k to meet your future goal.

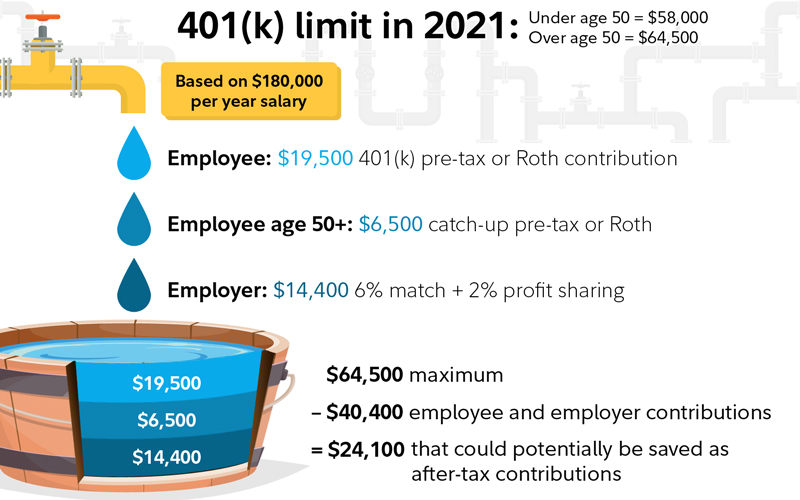

For governmental 457b plans only. The annual elective deferral limit for a 401k plan in 2022 is 20500. Catch-up contributions allow savers age 50 and over to increase contributions to their qualified retirement plan up to a maximum of 6500 for 2020 in excess of the IRS limit of 19500.

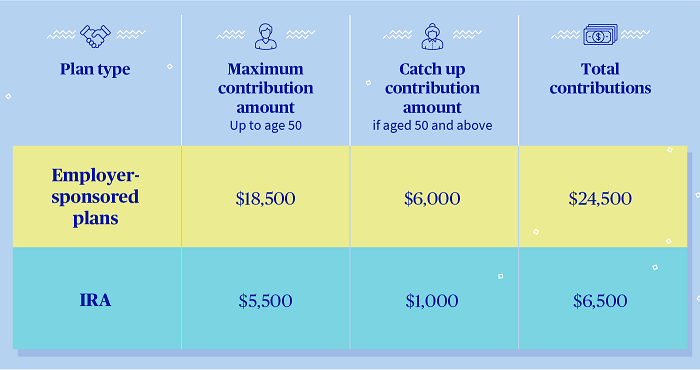

Build Your Future With a Firm that has 85 Years of Investment Experience. Those who are 50 years or older can invest 6500 more or 27000. 4 rows For participants who are age 50 or older at the end of 2018 catch-up contribution limits.

Example - plan-imposed limit. However employees 50 and older can make an annual catch-up contribution of 6500 bringing their total limit to 27000. Calculate how much more you could be pumping into your retirement savings.

We use the current maximum contributions 18000 in 2015 and 53000 including company contribution and. The catch-up contribution limit is 6500 in 2022 for people age 50 or older. Workers ages 50 and older have a higher annual 401 k contribution limit than their younger peers.

Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. The overall maximum amount that can be added to a 401k including catch-up contributions is. Individuals who are age 50 or over at the end of the calendar year can make annual catch-up contributions.

It simulates that if you contribute. So the total you can contribute. Assuming a 7 annual return on your 401 k investments your account would grow to 20865 by next year.

Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. The annual maximum for 2022 is 20500. In 2022 you can contribute 20500 to a 401k.

In 2022 this catch-up contribution was 6500 meaning that those ages. Your annual 401 k contribution is subject to maximum limits established by the IRS. It provides you with two important advantages.

A 401 k can be one of your best tools for creating a secure retirement. The maximum you can contribute to a 401 k is 20500 in 2022. Ad Choose Your Plan and Calculate Between Several Options for Tax-Advantaged Savings.

Your employer needs to offer a 401k plan. The limit on catch-up contributions for 2018 is 6000. The maximum catch-up contribution available is 6500 for 2022.

For those age 50 or over who are making catch-up contributions the limits are 26000 in 2020 an additional 6500. Reviews Trusted by Over 45000000. Calculator to Estimate Potential Contribution That Can Be Made to Individual 401K Plans.

Annual catch-up contributions up to 6500 in 2022 6500 in 2021. The catch-up contribution amount is 3000. If you are age 50 or over a catch-up provision allows you to.

Deferral limits for 401k plans are 19500 in 2020. The annual 401k contribution limit is 20500 for tax year 2022 with an extra 6500 allowed as a catch-up contribution every year for participants age 50 or older. Compare 2022s Best Gold IRAs from Top Providers.

The contribution limit for SIMPLE retirement plan accounts is 14000 in 2022.

Are You Eligible For Catch Up Contributions Generations Wealth

Solo 401k Calculating My Solo 401k Contributions For A Sole Proprietor My Solo 401k Financial

The Ultimate Roth 401 K Guide District Capital Management

Retirement Services 401 K Calculator

The Maximum 401k Contribution Limit Financial Samurai

The Maximum 401k Contribution Limit Financial Samurai

Catch Up Contributions How Do They Work Principal

Solo 401k Contribution Limits And Types

A Comprehensive Analysis Of 401k Catch Up Contributions Wealth Nation

Infographics Irs Announces Revised Contribution Limits For 401 K

Solo 401k Contribution Limits And Types

Corporation Calculating My Solo 401k Contributions For A Corporation My Solo 401k Financial

How Much Can I Contribute To My Self Employed 401k Plan

A Comprehensive Analysis Of 401k Catch Up Contributions Wealth Nation

Free 401k Calculator For Excel Calculate Your 401k Savings

401 K Calculator Credit Karma

How To Catch Up In Your Retirement Savings Plans Equitable

Komentar

Posting Komentar